Wind, Solar Farms Are Seen as Havens in Coronavirus Storm

Thursday, April 9, 2020

Re-posted from an article by Russell Gold in the Wall Street Journal

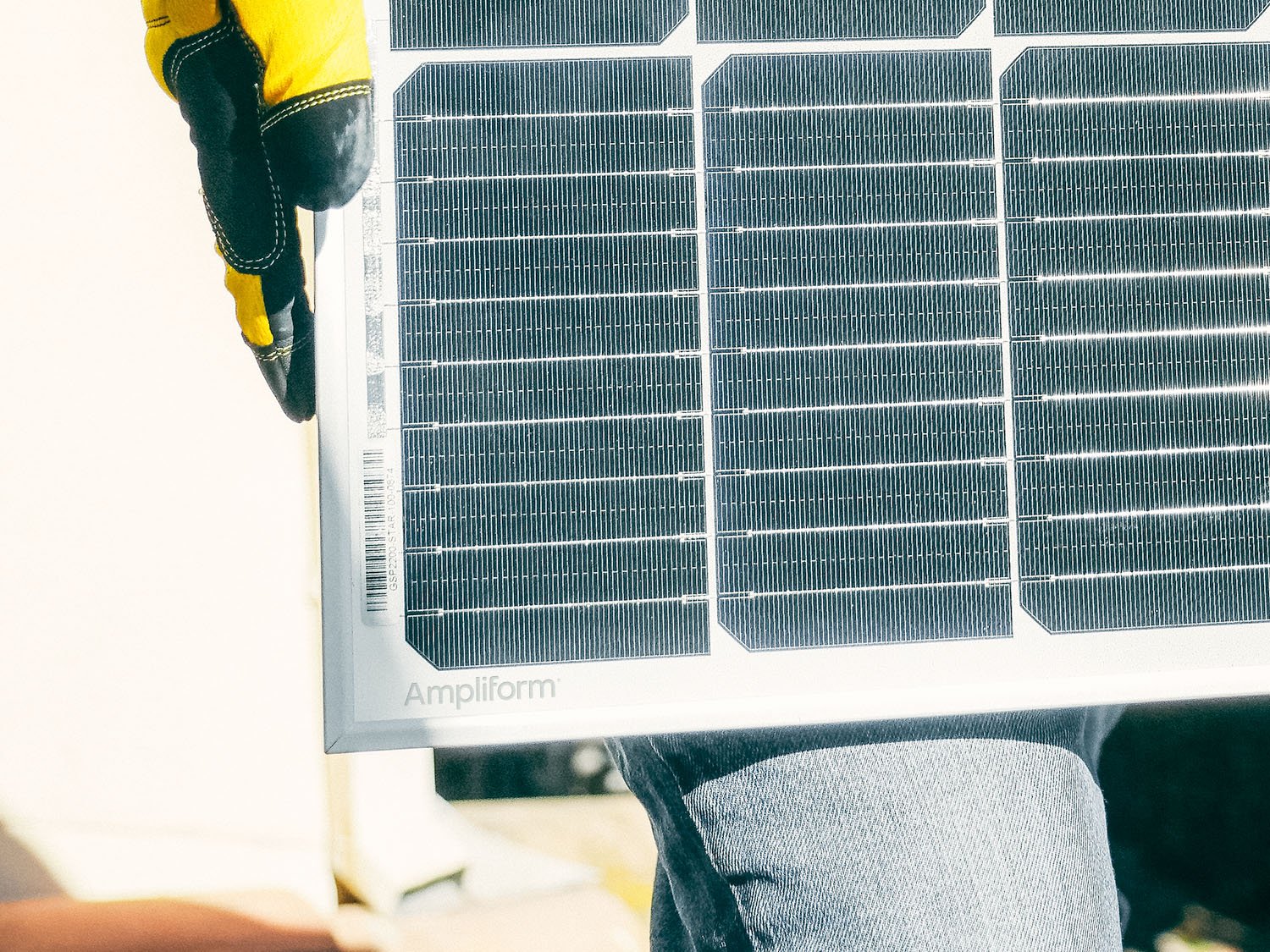

Steady returns in renewable energy attract investors, even as new projects likely face finance hurdles

Wind and solar farms are attracting interest from investors hungry for low-risk, stable-yield opportunities at a time of extraordinary market volatility.

That interest is a boon for renewable projects, and could give them a financial boost in coming months and years. However, developers could face challenges in getting additional new projects financed and built amid the turmoil created by the new coronavirus.

It might seem an odd time for a renewable-energy uptick, given the economic slowdown and a historic crash in oil prices that is making fossil fuels cheap. But wind and solar farms experienced a similar surge after the 2008 financial crisis, when investors seized on the projects as safe-harbor investments with yields in the mid-single-digit percentages.

Wind and solar farms have contracts to sell their electrical output to utilities and companies with good credit ratings for a decade or longer, making their returns stable and relatively low risk.

“There is certainly some increased interest and discussion around uncorrelated yields, and renewables falls into that category,” said David Giordano, global head of renewable power at BlackRock Inc. “As I’m trying to stock my cupboard with canned goods, we have an awful lot of calls happening.”

The increased interest is fortuitous for renewable-energy builders such as Kevin Smith, chief executive of the Americas at Lightsource BP, a solar developer half-owned by British oil giant BP PLC. On March 12, he signed a deal with banks to finance a $250 million solar project in North Texas, even as the Dow Jones Industrial Average ended the day down 2,352 points.

“It was a strange day,” Mr. Smith said. He said he expects to close a further $750 million in solar financing this year, including a large solar farm in Colorado. “I’d like to think that there will be more investors from infrastructure funds looking at renewable markets as a safe haven from the volatility,” he added.

Corporations contracted for 46% of the 20.2 gigawatts of renewable energy added to the U.S. grid last year, according to the Renewable Energy Buyers Alliance, a group that represents corporate purchasers. The largest buyers last year were Facebook Inc., Alphabet Inc. unit Google and AT&T Inc. Corporations have been contracting for renewable energy because prices are low and because many have made pledges to lower their carbon output.

“No one has yet indicated that they intend to slow their purchase,” said Miranda Ballentine, the group’s CEO.

Still, finishing existing projects, much less building new ones, might prove difficult. Developers could face some significant hurdles in coming months, including shortages of labor and specialized tax-equity financing. The U.S. industry relies on tax credits.

Renewable-energy lobbying groups are seeking relief from Congress, either in the form of cash grants instead of tax credits, or extensions to allow delayed projects to still qualify for credits. But renewable-energy projects weren’t included in the $2 trillion coronavirus stimulus bill, and it isn’t clear any assistance is forthcoming.

For now, deals are continuing. Only 4% of near-term deals have requested delays, said Bryce Smith, CEO of LevelTen Energy Inc., an online marketplace that connects buyers and sellers of renewable energy.

“These are long-term investments,” he said. Supply contracts can last from 10 to 15 years.

Earlier this month, the Tennessee Valley Authority solicited proposals to build 200 megawatts of wind or solar power. It said it expects to sign a contract with the winning bidder in September.

“If you have a project in the chute, and you are working toward a closing in the next week or month, or months, my guess is that those projects get done,” said Paul Gaynor, CEO of Longroad Energy, a Boston-based renewable developer. “For projects that are expecting to enter the finance market in the second half of 2020, I think it’s a total toss-up right now if it gets done.”

Once completed, demand for wind and solar farms is as strong as before the spread of the coronavirus, and maybe stronger. In the years after the 2008 financial crisis, infrastructure investors’ appetite for wind farms in particular rose rapidly as they chased better yields.

That enthusiasm helped drive the rapid growth of the industry, which took off after the economy began recovering in 2010 and kept rising. In 2009, wind and solar generated 1.9% of U.S. electricity, according to Energy Department statistics. A decade later, they accounted for 9.9% of the nation’s power.

Investor interest in stable yield could again rise and drive additional growth in the sector. A solar farm can generate about a 7% yield, according to several people involved in financing these deals.

“Renewable-power generation is largely uncorrelated to oil and natural-gas markets, which further strengthen their overall appeal, and may well be one of the first assets classes to unfreeze,” said Keith Derman, co-head of Ares Infrastructure and Power at Ares Management Corp.